Investment Advisors - An Overview

Table of ContentsThe Buzz on Investment AdvisorsNot known Incorrect Statements About Investment Advisors The Greatest Guide To Investment AdvisorsTop Guidelines Of Investment Advisors

Even when you die just before the total time frame, your beneficiaries are going to continue to obtain the annuity. Round figure This possibility enables you to choose an one-time cash money remittance right now, for no further repayments. 4) When intending your retirement revenue, it's necessary to take taxes into consideration. Eventually, there are three different tax treatments in retirement life. The very first procedure is actually taxable funds, which have to be stated on your income tax return as well as undergoes tax obligation. Examples consist of advantage gained in financial account and also taxed reach sell in a broker agent profile when you offer it. The second tax obligation therapy is tax-deferred. Your tax-deferred.accounts are actually profiles where you failed to pay income tax on your addition or seed loan. Examples of tax-deferred profiles are 401(k )s and IRAs. These profiles additionally increase tax-deferred, so you don't pay for tax as they increase in value. Rather, when you pull amount of money away from these accounts, your withdrawals will certainly be taxed as usual profit. With a tax-free account, the income taxes were actually spent on the addition, therefore development as well as withdrawals are certainly not taxed, so long as you observe IRS laws. Examples of tax-free accounts are actually municipal connects, Roth IRAs, and also particular sorts of money worth insurance policy. Along with a very clear revenue strategy that takes income taxes in to profile, it might be actually possible to proactively reduce your tax obligation bill during retired life. Typically, the greater your internet really worth, the greater impact retired life tax obligation tactics can easily possess.

However, helping make intentional retirement life revenue plan choices around income taxes can easily cause substantial tax obligation cost savings for many Americans, while overlooking income tax preparation may possess very painful tax obligation effects. 5 )The technique you invest should modify as you near retirement. This is funds you're depending upon accessing in the temporary. You'll want to protect this cash from market volatility and also opt for very conventional monetary musical instruments

This bucket keeps cash you won't require to accessibility for 4-6 years. It holds traditional assets that will certainly restore the temporary pail when run through. 6 )Among the largest properties lots of Americans have is their residence. For some Americans, a practical technique is to downsize their property by offering it, and then make use of a section of the gains to finance retirement life.

Unknown Facts About Investment Advisors

Uncle Sam has created this approach job from an income tax viewpoint. Currently, if you are actually wed, you can spare around$500,000 of increases when you offer your home(this exemption is actually made it possible for every pair of years ). Regardless of why you operate, the added earnings you make will definitely additionally be actually included in your planning as it can reduce the quantity of properties required to draw down for

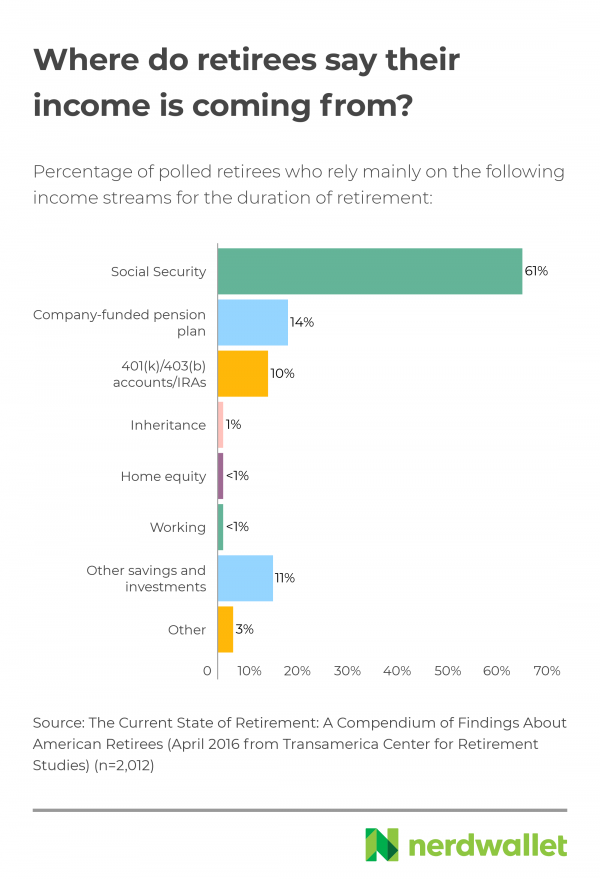

capital. Using your existing way of living as a foundation, you may imagine what expenditures could decrease or fade away a child's college expenditures or even home mortgage settlements, for instance as well as which may increase, like travel or even healthcare prices. You may after that make projections regarding your revenue. What do you anticipate to obtain coming from your concern in an organization or even land ownership? Rental property income? Individual retirement account or even various other financial investments? Pension plans? Social Safety? For clients whose income assumptions and needs are actually rather very closely matched, it assists to accomplish accurate organizing that predicts the income stream and also expenditures for each and every year.

A pension is an insurance policy product that delivers the buyer along with an assured profit forever. When obtaining a retired life annuity, you may do so as an instant or a fantastic read even prolonged alternative. For most much older grownups, immediate pensions are more preferred due to the fact that they start shelling out within a month of being acquired.

If you choose to permit your primary rise prior to receiving payouts, you decide for a put off annuity. Typically, those experiencing retired life will certainly take loan gotten during the course of their operating years to purchase an instant allowance.

Some Known Facts About Investment Advisors.

Deposit is actually ideal, however without a key drawback program you could possibly end up lacking your financial savings with years entrusted to reside. Strategic drawback features a technique for reversing your cash as well as using it as cash circulation along with allowing what you still have in discounts to proceed to benefit you.

Advertising & Content Declaration Last Updated: 1/26/2023 quality verified Quality Verified If you're moving right into retired life, the final thing you wish to stress over is how you'll remain to generate income. Finding earnings without operating may be made complex for more mature adults, however it is actually possible. It's essential to comprehend your alternatives and understand possible shams.

An annuity is an insurance coverage item that offers the buyer with an assured income forever (investment advisors). When acquiring a retirement allowance, you may carry out so as an immediate or even deferred possibility. For a lot of much older adults, prompt allowances are actually much more well-known because they begin shelling out within a month of being actually bought.

Investment Advisors Things To Know Before You Buy

If you favor to allow your main boost prior to getting payouts, you decide for a More hints put off allowance. Normally, those encountering retired life will take cash earned during their operating years to acquire a prompt pension.

They are actually long-term: Once you buy an allowance, you can't change your thoughts. Protection: Annuities are actually not affected through stock rates or rates of interest. Pension reference value lessens with time: As an end result of inflation, your investment value will reduce in time. Secure revenue payment: Your earnings remittance will certainly certainly never boost along with a pension.

Loan in the banking company is suitable, yet without a calculated drawback strategy you could possibly find yourself losing your cost savings along with years delegated to reside. Strategic drawback includes a procedure for reversing your cash as well as using it as money flow besides allowing what you still invite financial savings to carry on to benefit you.